Get the Most Out of Selling Your Home:

A Seller's Guide

From Hillary Lane Real Estate

Dear Future Seller,

I’m thrilled that you’ve invested your time to read our Seller’s Guide!

Selling a home involves many moving pieces and strategic considerations. With this guide, you’ll be better prepared to maximize the sale value of your home and avoid common mistakes sellers make.

Sellers truly benefit from an agent who takes the time to understand their goals and concerns, create a thoughtful strategy unique to their situation, and manage the entire process from pre-listing to beyond closing. Working with a trusted professional is the best way to avoid costly pitfalls, protect you from risk, and ensure the successful negotiation of a favourable deal.

I’ve pulled together the best of my knowledge and experience to support your selling journey. Going far beyond the basic steps, I’ll take you through the many moving parts of the real estate selling journey. From coordinating the right team and preparing your home to get the best price to strategically negotiating a stellar deal. Working with a trusted professional is the best way to avoid costly pitfalls, protect you from risk, and ensure the successful negotiation of a favourable deal.

This Seller’s Guide will make sure you always feel in control of the process, so you can ensure success in any market.

If you have any questions or concerns, please don’t hesitate to reach out.

Yours truly,

Hillary Lane Real Estate Broker

Proudly Top 1% for Toronto and the GTA

About Us

Hi, I’m Hillary Lane.

I’m a real estate broker with nine years of experience in the Toronto and GTA market.

I came to real estate by way of building and renovating homes with my contractor husband. This means I understand the financial side of home selling on a fundamental level and how to best position a property to appeal to potential buyers. I appreciate both the emotional complexity of selling a home as well as the importance of developing a strategic approach to achieve your goals.

As a broker, I’m here to be your guide on through the real estate journey. I believe my job is to empower and support you through the process of selling a home, so you feel confident at every step. My analytical, detail-oriented approach focuses on getting the job done, while never forgetting the human elements of the home selling journey. Often described as tenacious, I’m here to ensure that your selling experience runs smoothly and exceeds expectations.

My clients often express their appreciation for the way I take time to understand their needs. To me, it’s all about your end goals: What is most important to you? How will your day to day be impacted by the selling process? Whatever your goal might be, I will find the right process and strategy for your specific needs – so you can make smart and informed decisions to get there.

Things my clients mention most are my communication skills, sophisticated negotiation tactics, and ability to effectively navigate challenging situations. I can confidently say these skills come from a strong foundation of volunteering for over a decade on crisis and suicide prevention hotlines.

I’m honoured to say that many of my clients have become friends throughout the process, with a little fun and laughter along the way.

Giving back is a big part of my life. As part of my Pay It Forward initiative, I donate a portion of each commission to support two special organizations: Sistering, a non-profit organization supporting at-risk precariously-housed women, and Covenant House, an organization that supports unhoused, trafficked, or at-risk youth.

It would be a privilege to help you navigate this exciting next chapter. I would love the opportunity to get to know you better and discuss your goals.

Client Stories

The Home-Selling Process

Selling a home is a big deal! Whether it’s your first sale or your third, there are so many steps in the process that it can often feel overwhelming.

Over the years of working with clients, I’ve found that it’s easiest to digest the process in small bites. I’ve broken it down into six steps that make all the complexity more manageable.

How to Use This Guide

I’ve covered each step in the selling process in a different section of this guide. Within each section is everything you need to know to make informed decisions about your home-selling experience.

If you are selling your first home, or your first investment property, I recommend starting with Step 1. If you have been through the process before and are looking for a refresher, feel free to skip to the sections that are top-of-mind for you right now. You can always circle back to other sections as needed.

Of course, if you have questions about anything in this guide, I’m always here to help. Simply reach out anytime: Hillary@HillaryLane.ca or (416) 882-4707

Our homes are incredibly important parts of our lives. Transitioning homes can be a sensitive and complicated process, particularly if you and your family have a strong emotional connection to your current home.

A good agent will support their clients by helping them set goals and manage their expectations. Having a clear intention helps to clarify the steps needed to achieve your goals and manage the emotions associated with selling a home.

Setting Goals and Expectations

When selling a home, the three most common goals are maximizing profit, minimizing stress, and protecting privacy.

As with any real estate transaction, nothing is more empowering than knowledge.

If you haven’t purchased or sold a home in a long time, you probably have a lot of questions about the current market. What is the general condition of the market today? Are bidding wars certain due to low property availability? What are buyers looking for in your neighbourhood? How long do homes in your area take to sell?

Your agent should be able to answer these questions and help supplement any gaps in your knowledge about the process and the current market.

When you understand your goals and your fears, it becomes easier to adjust your mindset to prepare for selling and make an effective plan to meet your needs. The more you know about both your goals and the market, the easier it is to manage your own expectations.

Maximizing Profit

If getting top dollar is your main goal, carefully consider how much effort you’re comfortable putting into meeting this goal. Effectively preparing your home to achieve the highest profit takes time, energy, and the right strategy.

While some homeowners are happy to roll up their sleeves and get their hands dirty, others prefer to outsource the work of getting ready to sell. Doing the preparation yourself will take personal time and energy. Hiring an effective team will require financial and logistical resources.

With the help of sound guidance from your agent, you can strategically prepare the property to yield the best price without wasting time, effort, or money.

Minimizing Stress

Minimizing stress is also a very common goal. Selling your home will mean disruption to your routine, but restricting showing times could mean sitting on the market longer.

It is important to weigh the pros and cons of disruption against a sale that allows you to get your life back to normal quickly. Your listing strategy needs to balance interruptions with adequately marketing your home.

Maintaining Privacy

Privacy is also an important priority for some homeowners. In general, properties with the highest sale price also have the highest exposure on the open market. If privacy is an important consideration for you, then there are options to sell in a more confidential manner. Share the concerns with prospective agents during the interview process. An agent who is a good fit will be able to be flexible, connect you with the right resources, and offer support where you need it.

Addressing Your Fears

It is only natural to have fears about selling your home. Moving from a property you have made your home can raise concerns about the unknown. What if no one wants to buy? What if you buy first and your current home is taking too long to sell? What if your neighbours are nosey or noisy? What if you miss an opportunity to sell a better time?

You should feel comfortable voicing your fears to your agent. They are in the best position to address them and offer advice accordingly. This not only helps set your mind at ease, but also allows your agent to ensure their listing plan considers these elements.

Understanding Selling Costs

Of all the questions sellers have when they begin the process of listing their home, questions about the costs involved are by far the most common.

This section provides an overview of the costs you can expect when selling your home.

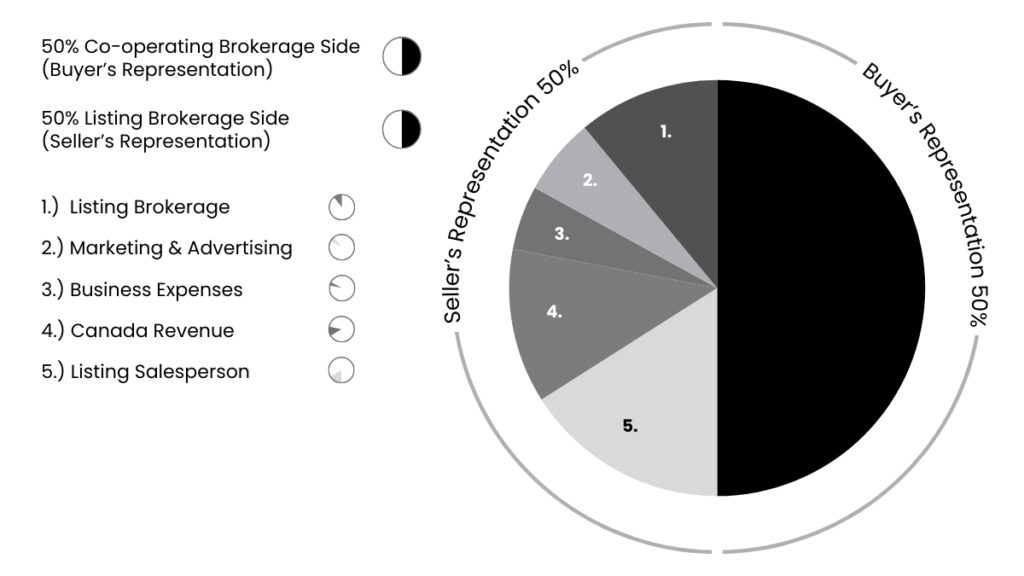

Real Estate Commissions

Real estate commissions are how agents are compensated for their time and efforts. Currently in Ontario, it is typically the seller in a transaction who pays the commission of both the listing agent and buyer’s agent through the listing broker. The buyer’s agent commission is called a cooperating commission. Both commissions are paid through the listing brokerage and are set out at the time the home is listed. On closing, the total commission is subtracted from the seller’s profits from the sale and are transferred to their respective brokerages on closing.

Cost: variable depending on services offered but a good estimation point is approximately 4-6% +HST of property sale price.

See Step 2: Choose Your Team, section Understanding Real Estate Commissions for more detail.

Home Repairs

Most homes need a little TLC to perform well on the market. While some require basic decluttering and redecorating, others will require more substantial painting and repairs. Your agent will advise you which preparations and repairs will yield a higher return on investment and impact your sale.

Generally speaking, activities that have the most impact include decluttering and staging, painting, installing new light fixtures and hardware, improving curb appeal, and updating kitchens, and bathrooms. Many full service agents will include staging as part of their commission package, however, repairs are generally up to the sellers.

Cost: variable depending on the scope of work but a good estimation point is $5,000-10,000.

See Step 2: Preparing to List in the next section for more details on this.

Legal Fees

You’ll require the assistance of a real estate lawyer to ensure your transaction closes smoothly. While this varies from property to property, a few thousand dollars will likely be sufficient for competent service on your sale.

Cost: average $1,500-3,000.

Moving and Storage Costs

If you’ve ever moved before, you know these costs vary widely and can add up quickly. Depending on the size of your home, this can range from as little as $500 for a truck for the day to upwards of $5000. Be sure to get three quotes and look for well-reviewed/recommended service providers to entrust your belongings to.

Cost: average $2,000-4,000.

Mortgage Discharge Fees

There may be a fee for ending your current mortgage early, called a mortgage discharge fee. These fees are generally negotiated at the time you enter into your mortgage, but you should verify with your lender if there are any penalties for transferring or cancelling your mortgage. They will be able to provide details on the exact fees and process for discharging the mortgage.

Cost: variable.

Tax Implications

While most residential real estate transactions are not subject to taxes, there are some cases where taxes will apply. For example, primary residences are exempt from capital gains taxes, but investment properties are not. If you are not a permanent resident, then you may be subject to a withholding tax as a non-resident. New home construction can be subject to HST. Be sure to speak with your account and your real estate lawyer about what taxes will apply in your specific situation.

Cost: variable.

Preparing to List

Potential buyers make almost instantaneous decisions after viewing the property online about whether they will ask for a showing of your home. Once inside, they will decide within seconds if they will consider buying it. It is incredibly important that it presents well and draws in as many potential buyers as possible.

The period before listing your home requires some effort, and flexibility, but it will certainly be worth your time in the end. You only get one chance to make a great first impression. Don’t be afraid to make a small investment if it’s likely to yield a larger or faster return.

This section includes the main areas you will want to review and plan to address when you are preparing to list your home.

Cleaning

A thorough, professional cleaning sets a clean slate that makes it easier to keep your home tidy for viewings. Cleaning should address your entire home top to bottom and everywhere in between including:

- All appliances (inside and out)

- Grout and tile

- Carpets and floors

- Dusting of all surfaces

- All exposed surfaces and air vents

- Interior and exterior of cupboards and cabinets

- Interior and exterior windows

Decluttering and Depersonalizing

This is usually the most difficult process as it requires removing many of the details and items that make your house a home. While this can be uncomfortable, it’s an impactful and important part of the process.

Decluttering opens up your space, creating a calm, welcoming environment that appeals to a wider range of potential buyers and better showcases potential. All parts of the home should be decluttered, including storage areas. In our experience, most sellers need to reduce the items stored in their closets and cupboards by half to best showcase their homes. Decluttering and depersonalizing includes:

- Editing furniture to the bare minimum to create purpose within the space

- Clearing out and organizing closets to highlight more storage

- Clearing floors of clutter in all rooms and in storage spaces

- Removing any pet toys, dishes, and crates

- Organizing and clearing counters in the kitchen and bathrooms

- Clearing out and organizing cupboards the kitchen and bathrooms

- Removing personal items like pictures, notes, collectibles, and keepsakes

Removing Chattels

Unless specifically detailed in your Agreement of Purchase and Sale, any items including furniture, hardware, or mechanicals that are affixed to the home are deemed to be included with the sale.

To avoid confusion at the time of closing, you can remove and replace any items you plan to take with you such as dining room chandeliers, other light fixtures, custom sinks and faucets, or window coverings. If it’s not possible to remove items then ensure that you have clearly communicated with your agent which items you’d like to keep.

Inclusions typically include:

- Appliances

- Lighting

- Window coverings

- Attached floor coverings

- Pool-spa equipment

- Water softeners

- Security systems/alarms

- Garage door openers/remote controls

- Mailboxes and street numbers

- In-ground landscaping

Repairs and Updates

If you’re opting to maximize your resale value, you’ll be trying to present your home in its most pristine condition. Buyers will often make a mental tally of items that need to be repaired or changed and adjust their offer price accordingly. Minimizing these flaws will help potential buyers rationalize a higher sale price. However it may not be within budget or reason to complete all possible repairs. Your agent will review your home room by room with you and prioritize a list of items requiring repairs that will maximize your return on investment:

- Replacing missing cabinet knobs and faulty doors

- Regrouting or replacing tiles

- Replacing light fixtures

- Replacing dated hardware

- Repairing or replacing appliances

- Repairing damaged or dated flooring

- Repairing or cleaning old carpets

- Replacing broken glass in windows

- Replacing light bulbs

Some sellers prefer to do these updates and repairs themselves, however your agent can recommend and help coordinate a reliable handyman or contractor if you’d prefer some assistance.

Painting

A fresh coat of neutral paint is one of the most reliable ways to create a welcoming and appealing space. It not only makes your home appear well-maintained, but allows buyers to imagine their own belongings in the space. It is by far one of the best investments for sellers as it is relatively low cost with high return.

Curb Appeal

Curb appeal improves the first impression potential buyers have of the home. As you know, buyers are making decisions very quickly, so having an instantaneous positive impression goes a long way. Creating a warm and inviting exterior makes people want to live in the home before they even enter. Some areas to focus on to improve curb appeal include:

- Painting any worn paint on trim and porch

- Repairing damaged windows, lights, walkways, and fences

- Creating a stunning new entry with a new coat of paint, handles, planters, doormat, door knocker, and house numbers

- Ensuring your front door opens smoothly and appears secure

- Tidying up landscaping including cleaning up debris, pulling weeds, mowing the lawn, planting some flowers, raking leaves, and shoveling snow

- Power washing the walkway, porch, steps, and siding

- Removing clutter such as garbage bins, trash, bikes, or tires on your property and in your garage

STEP 2:

Choose Your Team

Having the right team of trusted professionals will give you peace of mind when buying a home. Choosing reliable and experienced professionals to be in your corner will help you make confident, informed decisions. Your team will also allow you to minimize stress by knowing you’ve set yourself up for success.

Choosing Your Agent, REALTOR®, Sales Representative or Broker

A real estate agent, sometimes called a REALTOR® or a Sales Representative, is licensed to represent buyers and sellers of real estate. A real estate broker is a real estate agent with additional training, allowing them to open their own brokerage. All designations noted here are capable of providing you with the services you need to purchase a property.

Selling real estate is one of the most important decisions we make in our lives. It is essential to have trusted support to give you sound guidance, help you effectively navigate challenges, and ensure you are protected from liability and risk. Choosing reliable and experienced professionals to be in your corner will help you make confident, informed decisions. Choosing reliable and experienced professionals to be in your corner will help you make confident, informed decisions. Your team will also allow you to minimize stress by knowing you’ve set yourself up for success.

As a seller in Ontario, you have the option of working with an agent to sell your home or representing yourself as a Self-Represented Party (SRP). If you are represented by an agent (full-service or discount REALTOR®), they will be representing you as a client, meaning you are now covered by your agent’s insurance. You are owed fiduciary duties and lawful obedience. Your agent must maintain confidentiality and is required to go above and beyond in representing your interests. The additional services your agent will provide to you will be outlined in your listing agreement. More information on this is provided in the remainder of this section and Step 4: Signing with Your Agent.

Given the high value of real estate transactions and the need to mitigate risk and liability, choosing the right support is very important to the success of your sale. You’ll need someone who understands the market and has the experience and connections to make the process easier. Sales are an important part of your real estate agent’s job when it comes to interacting with other REALTORS® and potential buyers. However, as the client, you should never feel that your agent is selling you on something you don’t want. Your agent should act as your advisor and guide, counseling you on smart decisions and minimizing stress.

If you choose to work with a REALTOR®, you have options for levels of service and resulting commission packages. The particular services provided and commission charged will vary with individual agents, brokerages, and/or levels of service offerings. Generally, your options for representation include:

Generally, your options for representation include:

- Full-Service REALTOR®: This type of representation offers the most comprehensive set of services and inclusions (more information below).

- Discount REALTOR®: Due to the decreased commission, this type of representation does not include as much support or additional investment from your REALTOR®.

- Mere Posting: This option is usually a brokerage and assigned agent who will list your property on the MLS® system for a small fee.

The governing body of real estate in Ontario is the Real Estate Council of Ontario. RECO is responsible for ensuring REALTOR® compliance of the relevant ‘Trust In Real Estate Services Act, 2020’ (TRESA). Under the umbrella of greater transparency and understanding, Sellers will now have the required Information Guide provided and explained to them, together with other updated real estate documentation and processes. We welcome the opportunity to give this information to both buyers and sellers clearly and concisely.

The RECO Information Guide is available now for review. Click here to view the Guide.

What a Good Agent Provides

Good agents have well-rounded expertise to maximize the sale price for your home and help you achieve your goals. Below are some examples of all the moving pieces that they are responsible for leading throughout the process:

- Recommending staging, design, decluttering and repairs to ensure your home appeals to more buyers

- Managing marketing preparations such as staging, photography videography, social median and print campaigns

- Coordinating a network of experienced professionals to make your process easier and protect your interests and support your transaction

- Preparing your home for sale including setting the right price and strategy (should be able to substantiate any strategy or sale prices with relevant comparables and justification)

- Providing valuable market insights to help you understand what to expect throughout the process

- Identifying competing listings and gathering relevant information

- Leveraging their relationships with other agents to find more buyers while also making the negotiation process more successful

- Effectively marketing your home to maximize the amount of buyer interest and sale price

- Scheduling and conducting open houses

- Providing buyer and buyer agent feedback to overcome objections and adjust strategy

- Verifying and pre-qualifying potential buyers

- Protecting your interests through the entire offer process including composing and negotiating contracts that protect you from risk and liability and best represent your interests

- Presenting, reviewing, and evaluating offers to help you make smart decisions

- Acting as your liaison between buyers and their agents

- Representing your fiduciary best interests and providing lawful obedience

- Adhering to a strict Code of Ethics so all processes remain above board

A good agent is committed to taking care of your needs until closing and beyond, including being available to answer questions and address your concerns. You may begin interviewing agents well in advance of your ideal selling timing so that you have a well established relationship and can seek guidance on market timing, repairs and other considerations as you prepare to list.

Understanding Real Estate Commissions

How Much is the Commission?

Real estate commission rates are not standardized in Ontario. It is also illegal for brokerages to collaborate and fix commissions. Each brokerage or REALTOR® sets their own commission, including the cooperating commission. As with any service, you must be mindful of discounted approaches. It can be tempting to go for the agent with the lowest commission, but these agents tend to offer the bare minimum required. As a result, your bottom line and overall experience are greatly impacted.

Typically, the real estate commission is structured in one of three ways: a percentage of the sale, a flat fee, or a combination of the two, as agreed upon by the sellers and their agent. Generally, sellers in Ontario cover both the commission of their listing agent and the commission of the cooperating buying agent who brings forward the offer (cooperating commission). Real estate commission in Ontario is usually broken down into three categories, managed by the Real Estate Council of Ontario (RECO):

- Sale percentage (example of 5%+HST*).

- Flat fee.

- A combination of 1 and 2 (example 4.5%+HST plus $10,000).

*Ontario does not permit sliding scale percentages, for example, 2.5% for $700,000 and 3% for anything above.

In our commission sale percentage example of 5%+HST, 2.5%+HST would be paid to the listing agent and 2.5%+HST to the buyer’s agent. The commission details will be agreed upon before going to market and detailed in the seller’s listing agreement. The funds are transferred from the sellers to both the listing and buying brokerages after closing.

As with other service industries, the cheapest rarely equals the best. You may be enticed to go with the agent who offers you the lowest commission, but it’s more than likely that they’ll also offer you fewer services and less comprehensive representation.

Since real estate is likely one of the biggest financial decisions you’ll ever make, carefully consider the impact of your agent choice. Is it more important to save on commission or net the highest price on your sale? What is the value of a more organized, better supported, and less stressful experience?

Full Service Agents

Full-service agents generally charge a full commission but include a host of services as part of this package. While it varies from agent to agent, some examples include:

- Complete staging of your home to get top dollar (not all staging is created equally, and in many neighborhoods, higher-quality staging translates into a higher sale price).

- Complete cleaning of your home so it is primed for viewings.

- Professional marketing based on your ideal demographic for your home style, location, and price, including HDR photography and virtual tours.

- Online and digital marketing package, including targeted ads, property website, and media.

- Print marketing materials, including feature sheets, postcards, and other advertisements.

- Expert negotiation to protect your interests, maximize your sale value, and ensure you get the best terms.

Double-ended Commissions

When a real estate agent represents both the buyer and the seller in a single transaction, the commission is double-ended, and this is considered multiple representation. When the property sale closes, the agent responsible for the deal receives both shares of the commission.

This is legal in Ontario as long as all parties involved consent to the terms in writing, but it can be tricky. This situation most commonly occurs when buyers visit open houses and want to submit an offer without having their own representation.

Before listing your home, you should discuss the various representation scenarios you may encounter, how you’d like to handle them, and how commission might be impacted. Your listing agent may reduce the overall commission if they represent both parties, or they or their brokerage might have a policy not to do so. This needs to be clearly disclosed to any competing buyers and can make things very complicated with cooperating agents. For more on multiple representation, see see Step 5: Get an Offer, section Offers and Negotiations.

Choosing the Rest of Your Team

The selling process requires a team of people working together to help you meet your goals. A good agent will connect you with the best people in their network to ensure your sale goes smoothly and your interests are protected.

Your real estate team often includes a mortgage broker, a home inspector, a real estate lawyer, an insurance broker, tradespeople, and listing vendors. While this is your basic team, your agent can also often assist in recommending an interior designer, contractor for renovations, and even a home organizer to help set your next home up once you move in.

Mortgage Broker

Home Inspector

Real Estate Lawyer

Insurance Broker

Tradespeople

Listing Vendors

STEP 3:

Create a Plan

There are many considerations and moving pieces when it comes to selling your home. Having a clear and thorough plan based on both your personal circumstances and the current market conditions will simplify the process and give you peace of mind. Your agent will provide insight and advice to help guide your decisions, but this step includes some things to consider when creating your plan.

Creating A Plan

Your agent should help to create a solid plan that includes preparing your property for market and a listing strategy to maximize your home’s potential. This plan should be based on elements discussed below. These fundamentals should be paired with personal lifestyle and risk considerations to find the ideal plan to meet your goals and accommodate your needs.

Timing the Market

It can be tempting to try to time the market to maximize your returns. The truth is that it’s impossible to predict the market with any certainty. Even the most qualified economists and statisticians can’t always accurately predict the market, so take the pressure off yourself.

This shouldn’t mean that you ignore market and economic trends, but you should combine trends with your personal circumstances and financial plan to figure out what makes the most sense for you.

The real estate market is seasonal. People tend to buy homes in the spring and fall, however markets have become increasingly unpredictable in recent years. You may find there is an advantage to listing when there are fewer homes on the market.

For example, if you list in the summer or winter, there may be fewer buyers, but you will also have less competition for your own property purchase. If you list in the spring or fall, you may get a higher selling price, but will likely pay more on your home purchase and run into bidding wars with high competition.

There are many metrics used to analyze market trends and make predictions such as months of inventory, average price trends, sales volume, days on market, and new listings. One of the more reliable measures to gauge the temperature of the market is to look at the sales to new listings ratio (SNLR). This gives you a ratio of how many properties are sold versus how many new properties come to market.

- >60% ratio: you’re in a seller’s market where sellers benefit from the advantage of more competition than supply.

- 40-60% ratio: you’re in a balanced market where supply and demand are in equilibrium.

- <40% ratio: you’re in a buyer’s market where there is much more supply than demand and buyer’s are in the driver’s seat.

While these metrics are useful to understand trends and current conditions, caution should be used when making predictions. When it comes to real estate there’s no crystal ball.

When making a decision about when to sell, your agent is the best person to guide you. They have helped many sellers through this exact decision by helping them evaluate their lifestyle considerations, family plans, larger financial picture, real estate goals and risk tolerance. Your agent will help you balance that against recent market trends to evaluate the best potential times to sell. All that you can do is make the best decision for you and yours with the information you have at your disposal at any given time.

What Your Home is Worth

While you and your agent should have substantial conversations about your home’s value and potential listing strategies, ultimately your home is worth what it sells for on the open market. Real estate can be a frustrating and inaccurate commodity compared to other high value assets because real people and high emotions are involved. While there are overall market trends and directions, things can shift week to week and vary greatly depending on the particular buyer’s circumstances, emotional state, and connection to a property.

Be wary of anyone giving you lofty market evaluations without being able to substantiate the reasoning. For realistic expectations and the best chance at a successful listing strategy, you’ll need someone who evaluates your home reasonably. Listing price is one of the most – if not the most – important aspects of selling your home. When priced properly, your home attracts serious buyers and is more likely to encourage multiple offers.

Determining your home’s value takes research to ensure it is appropriately priced and that it is likely to sell. You have three options when it comes to your pricing strategy. You can list:

- Below market value with an offer date or extended irrevocable period,

- At expected market value, or

- Above market value.

See Step 4: List Your Home: Listing Strategies isection below for more details on the various options.

Determining Your Home's Value

The main factor in setting your price is what comparable homes have recently sold for in the market today. There are several ways to determine market value, but there is no industry standard or consensus on the correct methodology. For our clients, we use a comprehensive analysis that includes a few different methods to establish market value.

Property Assessment Notices

This is the value placed on your home by MPAC (Municipal Property Assessment Corporation). It is the value used to determine your property taxes. This value is often under market value but can be used as a good point of comparison when looking at comparable properties. Renovations and updates are not always factored into these values.

Appraisal Value

For financing qualification, the buyer’s lenders may require an appraisal to determine the value of your home. This can be a part of a buyer’s purchase process or can be a part of refinancing your home or other lending considerations. Typically appraisal values can substantiate market value pricing when purchasing a home, but keep in mind when you have an appraisal for the purpose of refinancing they are more likely to be considerably under market value.

Current Market Analysis (CMA)

This method considers all the relevant elements of your home including location, size of home and property, number of bedrooms/bathrooms, condition, and unique features alongside current market conditions and relevant competition. In general, the more comparable properties in similar market conditions, the easier and more accurately you can substantiate market value. Assumptions and adjustments are made to contrast your home with the comparables and determine your estimated sale price. Depending on the type of home, price per square foot averages may also be a useful point of comparison.

Market Appreciation

By looking at how the market has behaved since you purchased your home, you can approximate its value in today’s market. It is good to look at both general trends but also more precise stats specific to neighbourhoods and types of homes. With this type of analysis you have to factor in whether or not your home is typical of the average home in the area and apply that to relevant appreciation.

Automatic Valuation Models (AVMs)

Many technology companies have built algorithms to estimate the market value of homes. These can be based on many complex market factors in addition to elements such as home size and neighbourhood. While these models are helpful as a barometer, they are by no means exact. They fail to quantify many nuances, unique elements, and how much a certain style or aesthetic may translate into value.

The Buyers’ Expectations

Another very important consideration is understanding the typical buyer in your area. Buyers and their agents develop a keen sense of the value for properties in the area during their searches. Your listing price should be in line with what a reasonable buyer expects to pay.

Local Market Conditions and Economic Factors

Taking a good look at the competition, demand, short and long term trends for your area, and type of home will also help forecast. Known government policy changes, interest rate adjustments and potential fluctuations in global markets may also be considered when evaluating timing and market projections.

Sell First or Buy First?

Whether to sell first or buy first can be one of the trickiest decisions you’ll have to make. Your agent is the person in the best position to help you determine what makes the most sense based on your plans, your financial situation, and the current market conditions. As a general rule, you take care of the most challenging piece first.

Benefits of Buying First

- You’ll have peace of mind knowing you’ll have a home to move into once your home sells

- You’re able to take your time to find your next home and be more strategic about your purchase decision

If it is a seller’s market, there is likely limited inventory, ensuring there is a lot of buyer competition and what is available sells quickly. In this kind of market, it will likely be easier to sell a home than it will to buy one. As a result, you may want to buy your next home first to reduce uncertainty and disruption to your life. For many young families it’s important to know where their next home will be before they are able to begin to consider selling their current home. The worst case scenario with this option is that you will not be able to sell before closing on your new home.

Benefits of Selling First

- You minimize the risk of carrying two properties at once

- You know with certainty what your home will sell for and funds available for your purchase

If it is a buyer’s market and there’s plenty of inventory, it likely means your home will sit on the market longer. In this kind of market, it can be a better option to sell first. You will know exactly how much your home is worth and you will avoid the possibility of not being able to sell before you close on your next home. This also means you’ll have less pressure to sell quickly, so you can be more strategic about accepting offers. The worst case scenario of this option is that you may need to find temporary accommodations, such as staying with family, in an Airbnb, or a rental property, while you are searching for or waiting to close on your next home.

Understanding Bridge Financing

If you are buying and selling, but the closing dates don’t align, you will need temporary financing to carry the costs of two properties. In cases like these, you may qualify for a bridge loan. This financing option allows you to use the equity in your home to cover the costs of your down payment on your new home. It “bridges” the gap between your existing and new mortgage. Bridge loans are only intended to be used in short-term lending situations and tend to have higher rates.

Depending on your financial situation, you can usually apply for a bridge loan with an A Lender, as long as you have a firm sale agreement in place for your existing home and for the home you’ve purchased at least two weeks before closing on your new home. If that’s not possible, you may need to look at an alternate lender who will have higher fees. Make sure you speak with your mortgage broker or lender about your requirements and ability to qualify.

Listing Strategies

When it is a balanced or buyer’s market, properties are often listed at market value knowing that it may take some time to sell. Listing well above market value in any market is rarely the strongest strategy since it discourages buyers and results in the property sitting stale. Overpriced homes often sell for less than they would have if they had been more appropriately priced from the beginning.

Keep in mind, your listing is only an invitation to receive offers and you are not bound to accept the sale price you have selected. The more appealing and in alignment with market trends that your list price is, the higher the likelihood of more, quicker and better offers.

Here are the three different types of pricing strategies:

1. Underprice with Offer Date

An offer date, also known as holding back offers, is the time when all interested buyers present their offers to the seller’s agent. When this date is set with a low listing price, the intent is to generate a bidding war or multiple offers at the same time. Often this strategy involves listing the home very far below the current market value to appeal to a larger potential buyer pool, and thus generate more offers. While it can be a nerve-wracking experience for buyers, it can be a very effective strategy in a seller’s market to encourage the highest price possible. There is no formula or percentage for how far under you should price, but a stronger seller’s market lends itself to greater margins between list and final sale price. The listing period may also vary but is typically one week from going live on the market to holding an offer date.

2. Overprice and Plan to Adjust Down

This strategy can be used in all markets, although it’s usually the most risky. The tendency is for overpriced properties to dissuade interest, reduce momentum, and sit on the market for prolonged periods of time. In these situations, sellers may want to leave room to negotiate or they may have an inflated sense of their home’s value. While some buyers may be willing to come see the home despite its lofty price, it will reduce the overall traffic and thus the eventual sale price. With this strategy, offers are reviewed at any time.

3. Price at Market Value

This strategy can also be used in all markets, but is more typical of either a balanced or buyer’s market or a luxury price point. With this strategy, offers are reviewed at any time. This transparent approach allows buyers to have a better understanding of the seller’s desired price prior to viewing or making an offer. If there are many recent and relevant comparables then this may be an easy value to determine and justify to cooperating agents and their buyers. For a more unique property, this can be more challenging. This scenario is less advisable in a strong seller’s market if it deviates from many comparables as it has a higher probability of leaving money on the table.

Irrevocable Period

Time limits, known as an irrevocable period, are placed as part of any offers in the Agreement of Purchase and Sale. These time limits mean that once the agreement expires, it can’t be accepted. During this irrevocable period once the offer is submitted, it also can’t be retracted. It is now in the seller’s hands to accept, reject, or sign back with different proposed terms. If there are changes to the terms during the negotiations, they must be included in writing during the irrevocable period to make them valid. See Step 5: Get Offers for more details on irrevocable periods.

Some sellers will elect to specifically request a particular irrevocable period such as 24 or 48 hours. This may be because there are multiple sellers to coordinate, a lawyer review may be required, the sellers are overseas, to get more than the listing price or it can be used as a negotiation tactic. In this case of the last two, you may request a long irrevocable period, giving you more time to shop around any potential offers and try to generate other competing offers.

Note: Whether you are having an offer date, accepting offers anytime, or requesting a specific irrevocable period, this information will be disclosed to buyer agents in the Brokerage Remarks section of your MLS® listing. This information is only visible to licensed agents and so buyers must rely on their agents to inform them of these particulars.

Effectively Marketing Your Home

The marketing strategy used by your agent is a very important element in a successful sale. Similarly to analyzing a home’s worth, there is no singular approach or industry standard. A full-service agent should have a comprehensive marketing package with a creative and stylish approach of attracting buyers to your home.

Professional Images and Video

Today, house hunting begins online, making the photos and video of your home the most important element of your marketing strategy. Unprofessional images shot with a phone just won’t cut it in today’s market. Professional images of a staged home will present your home in the best possible light, leading to more viewings. Together with a virtual tour, your home comes to life, which enhances buyer interest. Videos should be engaging and interesting so they stand out from the competition.

Staging

Staging is key to creating an emotional connection with potential buyers because it helps showcase a lifestyle buyers aspire to. From the moment they walk up to the door, buyers should be enticed into believing this is the home for them. Staging that appeals to your specific buyer pool will inevitably attract more offers.

Once your space has been decluttered and depersonalized, your staging strategy should be specific to your home. It should evoke the right response by setting the perfect balance between a warm welcome and aspirational living. Professional staging uses the latest design trends and an understanding of aesthetics to trigger emotions. Staging can sometimes be done in combination with your own furniture, while other times special furniture might be required to help set the right tone.

You also play an important role in staging by ensuring your home remains pristinely clean and tidy for viewings. It’s also important to pay attention to smells in your home created by smoking, cooking, and pets. Make sure the temperature is comfortable and in keeping with exterior conditions. If there are seasonal considerations, ensure the exterior is well maintained such as clearing snow or raking or sweeping leaves. It is advisable to keep lights on, so there is an instant impression when buyers enter the home.

The better you are at maintaining your home during the selling process, the fewer days your home will be on the market. For this reason many sellers opt for alternate accommodations during the listing period. If it’s an option to you then it can help to both greatly reduce your stress and positively impact the potential buyer’s experience.

Advertising Strategy

Your agent will develop an advertising strategy to attract more buyers for viewings. A strong advertising campaign often includes:

- Professional photography

- A dedicated website for your home

- A “For Sale” sign on your lawn with your home’s website URL

- Listing on local, national and international websites

- Professionally designed feature sheets

- Email campaign to local REALTORS®

- “Just Listed” postcards

- Interactive 3D tour

- Video tour that is posted on YouTube

- Google/Facebook Pay-Per-Click Advertising

- Open houses

All of these activities work together to get the word out to the right buyers and their agents. This creates a buzz and momentum getting people excited to come view your home.

STEP 4:

List Your Home

Now that you’ve prepared a solid plan it’s time to list your home. There are several options along the way. Your decisions should be based on current market conditions, the competition, and your goals and lifestyle considerations. Your agent will be able to discuss the pros and cons of any particular approach and help you make the best decisions.

Signing with Your Agent

As a seller in Ontario, you have three options for selling your home:

- Selling privately without a Realtor® as a Self-Represented Party (SRP): With this approach, you forego any professional real estate guidance, and you, as the owner, are responsible for your transaction from property preparations to liability beyond closing. This is also known as For Sale By Owner (FSBO).

- Selling with a Realtor through the public MLS system: With this approach, you’ll receive specified services from a registered Realtor to support the process of selling your home. Working with a Realtor allows you to access the public MLS system to advertise your home’s sale. This method is generally more favorable for maximizing the property’s exposure and ensuring a more successful sale.

- Selling with a Realtor® exclusively: With this approach, you’ll receive specified services from a registered Realtor ® to support the process of selling your home. Rather than being on a public registry, your property’s information can only be accessed between Realtors. Once the property is publicly advertised, you are required to be listed on MLS® within three days. While it generally means less exposure, it can be a great way to be more discreet, give your agent an opportunity to market the property privately, and allow for offers and coverage while your agent helps you prepare your home for market.

When you are represented as a client, the brokerage and agent are required to act in and promote your best interests and owe you a fiduciary responsibility. They also have a duty of confidentiality. If you are a Self-Represented Party (SRP), however, there is no requirement to act in your best interests or to keep information you reveal confidential. Any Realtors you speak with are free to communicate the information you provide to their clients, potentially negatively impacting your negotiating position. In either case, the broker/agent is required to act honestly, fairly, and with integrity. See Step 2: Choose Your Team, section Choosing Your Agent for more details.

Once you’ve found a good fit for your representation, have clarity on your timing, and a solid listing strategy, you can sign your seller representation paperwork. This includes acknowledging you’ve received and read through the RECO Information Guide, which describes the different types of representation possible.

You’ll also sign a Listing Agreement, which details the property, price, length and terms of your working relationship, the services provided, and the commission offered to your listing agent and the cooperating buyer’s agent. You may elect to be represented by the brokerage of your choice or select specific agent(s) as your designated representatives.

Your Listing Agreement can be signed in two ways: either as an exclusive listing or as an MLS listing. The choice will affect the property’s exposure and how it can be advertised.

- Exclusive: An exclusive listing means the listing isn’t publicly displayed on MLS/Realtor.ca but is instead marketed internally through your listing brokerage and your agent’s real estate network. While it generally means less exposure, it can be a great way to be more discreet, give your agent an opportunity to market the property privately, and allow for offers and coverage while your agent helps you prepare your home for market.

- MLS: An MLS listing means that other Realtors, brokerages, and clients will readily have access to the listing information and are granted permission to show the property upon request. This method is generally more favorable for maximizing the property’s exposure and ensuring a more successful sale.

When you’re working with a Realtor and listing on the MLS system, in addition to a listing agreement, you’ll also sign an MLS Data sheet detailing all the property information that will be available to the public on Realtor.ca. Note that these are standard forms created by the Ontario Real Estate Association (OREA) and are binding legal contracts between you and your agent or their brokerage. Take your time to understand exactly what you are signing and have your agent thoroughly explain each section to you. For more details on the documents you’ll encounter, check out the Forms Explained section at the end of this guide.

Finally, you may also sign additional forms detailing access terms (who is allowed in the home and under what conditions), lockbox and open house consent, staging contract terms, and seller directions for offer presentation, detailing how you’d like to handle various offer scenarios. These policies and requirements will vary depending on the brokerage and agent you work with. Make sure you have a copy of all documentation for your records. See Step 5: Get Offers for more about offer scenarios.

Your listing forms and seller representation documents can be signed in person or remotely via print and scan or electronic signature with a reputable company.

Seller Disclosure, Home Inspections, and Status Certificates

A thorough home inspection by a licensed home inspector can offer insight into the condition of the home and what sort of repairs may be required in the future. In some markets buyers may have the opportunity to conduct their own as either a condition of their agreement or prior to making an offer. In a seller’s market this is often not the case.

In this scenario, including a pre-list or seller’s home inspection may provide the additional peace of mind to help facilitate higher firm offers from interested parties. This can also allow sellers to remedy repairs prior to listing on the market and disclose information about the property.

While inspections may protect you against structural or material problems that aren’t always obvious to a layperson, they are by no means foolproof or a complete picture of the home. Inspectors do not look behind walls and are limited to what they can visually inspect.

Patent and Latent Defects

As a seller you are required to disclose any known latent defects, but you are not required to disclose patent defects. The difference is outlined below:

Patent Defects

Latent Defects

Other Issues

Status Certificates

The status certificate provides essential information specific to condos, including the financial status of the unit, as well as the financial status of the condo corporation. This is important as it shows buyers if there are any outstanding maintenance fees. It will also disclose whether the condo corporation is having financial issues such as a bankrupt reserve fund or ongoing special assessments due to underfunding.

When selling a condo, buyers and their lawyers will request a copy of the status certificate. Many sellers will provide this document to interested parties once they are listed to encourage multiple and firm offers. Buyers may make offers conditional on status certificate review or if available review the status before making an offer.

Optimizing Your Selling Experience

Your agent should be doing all they can to maximize your exposure, negotiate a great price and terms, and facilitate a smooth selling experience. There are several ways that you can also increase the likelihood of a more favourable offer.

Maximize Showing Availability and Flexibility

Showing availability and flexibility is extremely important. The more buyers through your home the higher the likelihood of multiple offers and thrilling results. Since buyers are often seeing multiple properties with their own schedule restrictions they may pass over listings that are difficult to integrate. The more flexible your schedule and the more accommodating you are to buyers and their agents, the quicker your home will sell.

Stay Away During Viewings

Similar to depersonalizing your home decor, you’ll want to have the home vacant for viewings. This way buyers can visualize the home as if it were their own and form a stronger emotional connection. It can be tempting to stay home during viewings, but it can impede and negatively impact your sale. In addition to making buyers feel uncomfortable, casual conversations between buyers and sellers can sometimes result in information inadvertently being shared and negatively impacting your negotiating position. This is another reason why securing alternate accommodations can be a great option during the listing period.

Be Flexible and Have Realistic Expectations

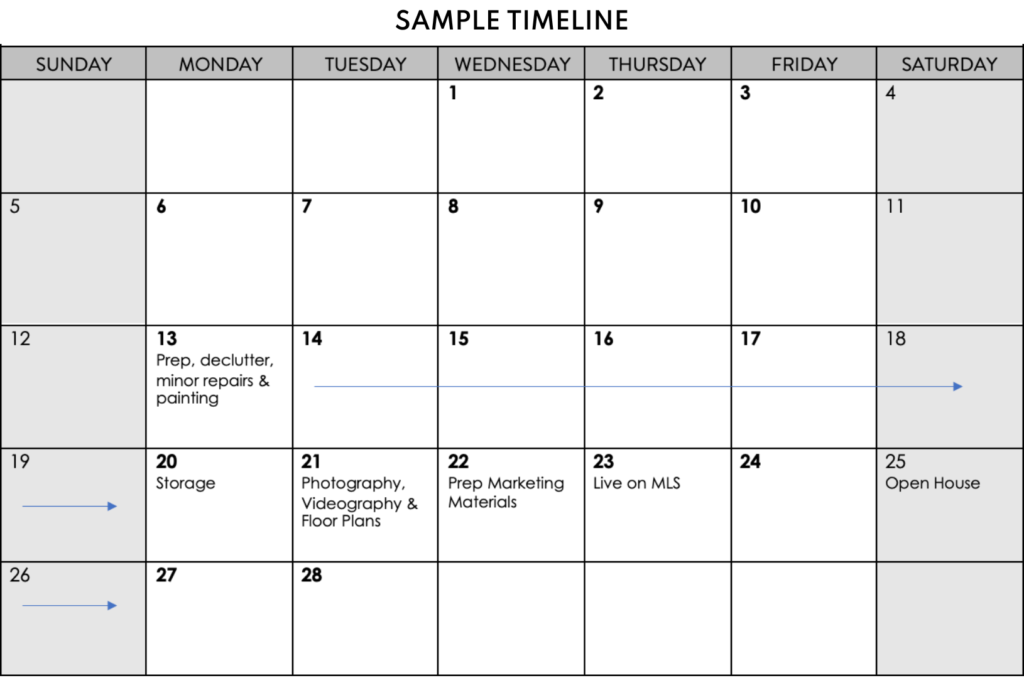

From the preparation phase to going live on the market to accepting an offer, you’ll want a detailed schedule to best prepare you for the journey. There may be changes or curve balls along the way, so it’s also very helpful to have a willingness to adapt as new information or new opportunities present themselves. Here’s an example of what your listing schedule may look like:

STEP 5:

Get Offers

The buyer’s agent will draw up an agreement with an offer price and any terms and conditions such as the number of visits before closing or an inspection. Your agent will set an offer date or will receive offers as they come in. In some cases, there could be multiple offers. Your agent will advise you on favourable terms and conditions and price. Each scenario is different and your agent will advise and work with you to determine whether you should accept an offer, make a counter offer, or pass. Your agent’s experience and negotiation skills will be very important during this process and should bring significant value to your experience.

Offer Paperwork

Agreement of Purchase and Sale

The standard Agreement of Purchase and Sale will have standard elements and several details that will vary with each offer. There are some variable elements that change with each offer that are detailed below. The agreement also comes with standard terms and conditions that don’t vary, describing document discharge, how closing arrangements will be made, insurance, the family law act application, etc. Have your agent send you a “forms explained” version of all documents that you’ll be signing well before making any offers, so that you can have time to carefully review and understand each section.

Some of the most common elements of an Agreement of Purchase and Sale include:

- Property address and legal description

- Names of buyers and sellers

- Lot size

- Price based on comparable listings and sales

- Inclusions and exclusions

- Any rental items

- Mortgage condition based on the buyer obtaining a mortgage

- Home inspection by a licensed home inspector and consequential repairs added to the terms if issues are discovered

- Deposit details (submitted with the offer or due within 24 hrs unless otherwise described)

- Closing date determining when the home changes hands and when vacant possession must be provided (if you cannot provide vacant possession this must be addressed in the schedules)

Schedules

Your agreement will also have terms and conditions in the schedules. These are recommended by the listing agent and the buyer agent to represent each of their client’s interests.

Terms are requirements for actions being taken or items included as a part of the transaction closing or warranties about the property, such as number of buyer visits or appliances/chattels being in working condition for example. Once both parties have agreed to the terms of the offer, it becomes legally binding. This means that if either party doesn’t fulfill their terms, the other may have cause to delay closing or take legal action.

Conditions vary from terms as they need to be waived or fulfilled in an agreed upon timeframe before the offer becomes binding, such as arranging of financing or the completion of a home inspection. If these conditions are not waived or fulfilled by the set timeframe, the offer becomes null and void.

When you set out the details for the terms and conditions of your offer, there are typically two schedules attached to the agreement.

- Schedule A: This schedule includes terms and conditions beneficial to the buyer. Common conditions describe having a home inspection or financing in place. Common terms include detailing the state of the home to be provided at closing and the number of buyer visits.

- Schedule B: This schedule includes terms and conditions beneficial to the seller. Your agent provides advice and recommendations of what should be included. Common terms might include how the deposit will be held and limiting the buyer’s ability to transfer or assign the agreement.

Note: Anything pertinent to your deal or any changes to the paperwork during the course of the negotiations need to be in writing to be legally binding.

Other Forms

You will also be signing Form 320 called Confirmation of Co-operation and Representation which clearly outlines how each brokerage is representing each party (as a client or as a self-represented party) and what commission is due to the cooperating brokerage on closing. An Offer Registration, or Form 801, can also be completed for each offer submitted detailing the time and the response to the offer.

Note: Per the Ontario Family Law Act, if the home is a matrimonial home then both parties need to consent to the sale. If only one party is on title then the spouse’s signature will be required in the Spousal Consent section of any accepted Agreement of Purchase and Sale.

For more details on the documents you’ll encounter, check out the Forms Explained section at the end of this guide.

Offers and Negotiations

Now that you have a good idea of what you’re likely to see in any submitted offers, let’s go into more detail about the process and negotiations.

Negotiations and Counteroffers

Once an offer is submitted, three things can happen:

- You can accept the offer without any changes.

- You can sign the offer back with a counteroffer, which will include changes to the price, closing date, or other terms and/or conditions.

- You can decline the offer or let it expire, ending this round of negotiations.

Note: Your agent can also request that the buyer(s) improve their offer without making a formal counteroffer. This often happens in multiple rounds with several competing offers in an offer date scenario.

The negotiation process is very nuanced and heavily influenced by your agent’s skill set and ability to effectively communicate with you and the cooperating agent. Your agent will use their experience to negotiate not just the highest price, but also the best terms for your situation. They should help balance your goals and risk tolerance with their strategic guidance (based on current market conditions and the particular negotiation dynamics) to advise you on the best course of action.

Offer Dates and Multiple Offers

An offer date is the time when all interested buyers present their offers to the seller’s agent. When this date is set with a low listing price, the intent is to generate a bidding war or multiple offers simultaneously. In a strong seller’s market, this strategy can lead to higher sale prices by leveraging competition between buyers.

How individual listing agents conduct offer nights can vary greatly, including the procedure on the day, the day of the week, the time of day for offer presentation, and the number of negotiation rounds. The number of negotiation rounds means that sometimes buyers will have one chance to submit their offers and the seller will make their selection. Other times, the listing agent will give a select few an opportunity to improve their offers, or the listing agent will encourage everyone participating to improve.

As a seller, you have the option of using an open offer process by selectively disclosing offer content to all the agents participating in multiple offers. However, a buyer has the option to include a provision in their offer to void it if the contents are disclosed. Should you opt for an offer date listing strategy or an open offer process, your agent will advise you on the best practices to achieve your goals given current market conditions and your specific situation.

Multiple Representation

Multiple representation occurs when a designated representative realtor or brokerage represents more than one client in the same real estate transaction. This can happen in various ways, including:

- A designated representative representing both the buyer and seller in the same transaction.

- A designated representative representing multiple buyers offering on the same listing.

- A brokerage representing both the buyer and seller in the same transaction.

- A brokerage representing multiple buyers offering on the same listing.

The key element is that there are competing interests. Because of this, the risks and impact on the representation provided must be clearly explained, and all parties must consent in writing if they choose to proceed.

Bully Offers

Although you might set an offer date, a buyer’s agent can choose to push back and submit an earlier offer, known as a bully offer or a pre-emptive offer. This tactic can be very effective as you’re likely to have less competition than on the offer date. It should only be used in specific situations and is a more aggressive strategy. You will have indicated in writing if you are open to pre-emptive offers or not. The buyer’s agent should communicate with your agent about your availability and interest in a bully offer before proceeding.

If you decide to formally view a bully offer, you are under no obligation to accept it. Once you decide to review a bully offer, your agent must notify anyone who has booked a showing or expressed interest in the property that you are advancing the date/time of offer review. They must also change the offer date instructions on your MLS listing in the brokerage remarks.

A successful bully offer needs to be enticing enough that you aren’t tempted to wait to see if you can do better on offer night when there is more competition. You must consider how many other offers you might potentially receive and how far a bidding war could push the final price up. For this reason, bully offers are almost always firm and close to the top range of value. You should also consider how many showings you’ve had thus far, how many more are booked before the scheduled offer date, the feedback received so far, your risk tolerance, and current market conditions.

Irrevocable Periods

Every buyer offer or seller counteroffer will include an irrevocable period. This determines how long the receiving party has to accept the offer, during which time the other party cannot make changes or cancel their offer.

In a hot market, buyers will often include a shorter irrevocable period to put pressure on the seller to make a quick decision. In a busy seller’s market with offer dates and multiple offers, it’s not uncommon to see very short irrevocable periods, such as two to three hours. In slower markets, the irrevocable period may be closer to 24 hours or more. For more on Irrevocable Periods see Step 3: Create a Plan – Listing Strategies.

Deposits

As the saying goes, money talks. This applies not just to a buyer’s offer price but also to their deposit. The bigger the deposit, the higher the chance of impressing you. It can provide peace of mind by showing their commitment to closing the deal (if a buyer is unable to close, deposits are often retained by the sellers). Unless otherwise specified in the offer, deposits are due within 24 hours of offer acceptance via bank draft or wire transfer. In competitive scenarios, a certified cheque or bank draft in hand is usually preferred.

The buyer’s deposit will be held in the listing brokerage’s trust account until closing. The deposit will be covered by your agent’s Real Estate Council of Ontario (RECO) required insurance for up to $100,000 for fraud, insolvency, or misappropriation. If the buyer is legitimately unable to waive or fulfill their offer conditions, their deposit should be returned to them in full. Once the deal is firm, however, even if the buyer can’t close, you may be entitled to all or a portion of the funds.

Once you have a signed Agreement of Purchase and Sale, the buyer’s deposit must be submitted to the listing brokerage for the deal to be binding. Deposits are required within 24 hours unless submitted with the offer or as otherwise described in the schedules. The buyer’s deposit will be held in the listing brokerage’s trust account until closing.

STEP 6:

Get a Firm Deal and Close

If all goes well, you accept an offer and a firm deal is signed. Your lawyer and the buyer’s lawyer will manage the paperwork and inform you of any issues that might arise before closing. In this section we will review what to expect from a firm deal until closing.

All conditions in the offer must be fulfilled or waived in their timeframe before the offer on your home is considered firm. All waivers, notice of fulfillments or amendments must be signed to make the agreement firm. It’s highly advisable not to share any details of your sale with neighbors or friends until you have a firm agreement and the deposit has been received. You never know what information can be inadvertently shared and damage a potential agreement.

Once your conditions have been waived or fulfilled you can officially celebrate, as you have a binding agreement. The final hurdle to be cleared is the closing. After you have a firm deal the sale will be reported to MLS® and a sold sign can be placed on the property. It’s advisable not to tell anyone about your sale price until you are ready to publicly announce it.

Buyer and Other Visits

When a home is financed by a lender, they may need to schedule an appraisal. Usually this is a quick inspection to confirm the value of your home aligns with the purchase price to protect the lender from providing a mortgage for an overpriced home.

The buyer also will have negotiated a set number of visits prior to closing. The buyer’s agent must give you notice of these visits and attempt to find a mutually agreeable time. In most cases, the new owner just wants to pop in to do some measurements, maybe consider paint colours, or in some cases bring a contractor in to provide a quote for work they want done. Your agent will continue to help coordinate everything to protect your rights and resolve any issues that might come up during the period before closing.

What to Expect Before Closing

Here’s a brief summary of various elements to keep in mind from six weeks out to closing.

Six Weeks Out

Get Organized

Reducing stress for your move should always be your agent’s goal once you purchase your home. You will need to change your address, utilities, services, and arrange for moving support.

Additional items to consider include:

- Car insurance and registration

- Your cell phone and internet provider

- Financial institutions such as banks and credit cards

- Magazine subscriptions

- Life insurance and wills

- Pet insurance

Plan the Move

Moving can be overwhelming, but with the right support it can help mitigate the stress. Movers, packers, or help downsizing can make a huge difference. You’ll want to schedule your movers well in advance. It makes the most sense to plan the move well before closing. If you’re moving out of a building with an elevator be sure to contact property management well in advance to book the elevator.

Insurance

Your home insurance needs to be effective you officially close. You can reach out to your insurance company to let them know about the sale and your closing date to ensure the property is protected up to closing. Should the closing be delayed for any reason make sure that you’ve let your insurance company know. Some people elect to have it insured a day or two after expected close to avoid any potential issues.

Visits

The buyers will have a designated amount of showings before closing as per your sale agreement (usually any appraisal visits do not count towards their total visits). The times must be mutually agreed upon (you’ll be able to approve them according to your schedule) and they will be accompanied by their agent for all showings.

Your Lawyer

The buyer’s deposit will be held in your brokerage’s real estate trust account until the lawyers close the deal. The buyer’s lawyer will have checked the title usually by two weeks before to verify any liens against the property and to ensure a smooth transfer. It’s a good idea to check in with your lawyer two to three weeks before closing to ensure you are on track and make an appointment to sign the final documents.

Mortgage

Four Weeks Out

Closing is only a month away there are a few more things you’ll need to do. They are…

- Confirm your movers are booked and any elevators, if needed

- Touch base with your lawyer to ensure they have all the necessary documentation they may need to close. Request a full summary of deductions and all closing costs

- Make sure you have collected all the keys for the property (including garage, fobs for condos, mailboxes)

- Arrange for any repairs or painting that needs to be completed

- Confirm your home insurance will be in place

- Ensure that you’re providing your property in the same condition as set out in your Agreement of Purchase and Sale. This might mean broom-swept condition; appliances, fixtures and systems working; and remedying anything that’s been damaged since you signed your firm deal

Two Weeks Out

With just two weeks until you move into your new home you should focus on the following:

- Make sure all relevant utilities and services have been cancelled

- Arrange to have a key left with your lawyer, concierge, agent or in a lockbox for the buyer

- Confirm the time of arrival for your movers

- Confirm your final signing appointment with your lawyers

One Week Out

This is the final countdown with your closing just seven days away. Be sure the following is all on schedule:

- Since you’ll likely be in your new home for a while before getting to unpack all your items, pack a “first sleepover” box containing essentials like medications, toiletries, linens, and a few changes of clothes. It can also be helpful to prepare a “moving box” with items like scissors, tape, ziplocks, allen keys, and tools so that you can dismantle and assemble furniture as needed

- Consider putting together a folder of medical documents, government identification, birth certificates, insurance policies, and any other important documents you don’t want to get lost in the shuffle

- Also consider preparing an unpacking box with items such as useful tools like a screwdriver and hammer, scissors, masking tape, cleaning supplies, plastic sandwich bags, and anything you’ll need to set up your furniture and get settled immediately

- Make sure all addresses have been transferred for important identification and institutions

- The buyer will likely do a final walkthrough this week, so ensure that all appliances and systems are in good working order

- Make a note to cancel your insurance a day or two after closing. Do not cancel until the property has successfully closed

- Confirm the time of arrival for your movers

- Confirm your lawyer’s appointment on closing day

Closing Day

This is the day you’ve waited for. Congratulations!

Just a few more steps take place on this day. Your lawyer transfers ownership and possession of the property to the buyer once they meet all the legal and financial obligations and the funds into your account.

- Ensure you’ve removed all your belongings. Take a second look through drawers, closets, and storage areas to confirm no items are left behind

- Unless you’ve otherwise specified with your lawyer, leave all extra keys and fobs somewhere in the open for the buyer to see (on the kitchen counter is a great spot)

- Ensure all windows and doors are closed and locked

- If possible, shut off the water to prevent any water damage between the time you vacate the property and the time the buyer officially moves in. If you take this precautionary step, notify your agent and leave a note for the buyer to ensure they are aware

Thank You

I hope you’ve found the information in this comprehensive guide helpful and now have a solid understanding of what’s involved in selling your home. The right guidance and support during this process can make a world of difference to your bottom line and experience.

I know it’s a ton of information and I’m here to help you feel informed and comfortable with the process.

Questions, concerns, thoughts? I’d love to hear from you. You can get in touch anytime: Hillary@HillaryLane.ca or (416) 882-4707

Yours truly,

Hillary Lane Real Estate Broker

Proudly Top 1% for Toronto and the GTA

Yours truly,

The Hillary Lane Real Estate Team

Proudly a Top 1% Team for Toronto and the GTA

Appendix

Tools and essential information to support your home selling journey.

Selling Forms Explained

When selling your property, you’ll encounter several standard documents, each with important details about your rights, risks, and obligations.

This version breaks down each section of these forms, so you can understand the protections and implications before signing. Familiarize yourself with what each form means to approach the selling process with confidence and clarity.

RECO Guide - Working with a Real Estate Agent: Things You Need to Know

Listing Agreement: Seller Representation Agreement

Agreement of Purchase and Sale: Freehold

Agreement of Purchase and Sale: Condominum

Confirmation of Co-operation and Representation

Offer Summary Document

Tips & Checklists

Glossary

Adjustable Rate Mortgage (A.R.M)

Mortgage with a rate that is variable. It is usually tied to the prime rate.

Agency

Relationship a buyer or seller has with a real estate brokerage company.

Agreement Of Purchase and Sale (AKA Offer)

Legal document that outlines the terms of a Toronto real estate deal that will be signed by both the buyer and the seller.

Amortization